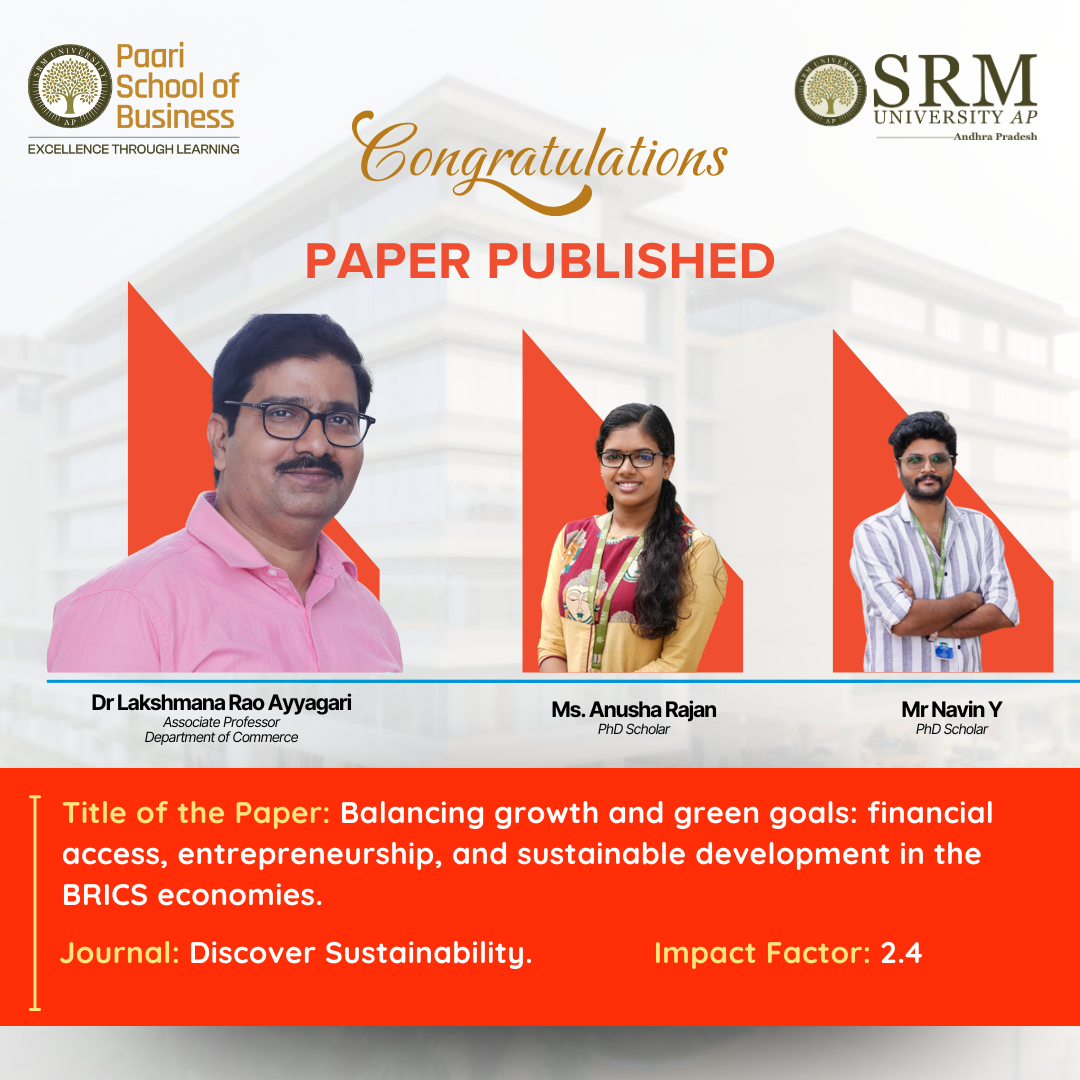

Financial access acts as both a catalyst and a challenge in today’s rapidly evolving economies. The research article “Balancing Growth and Green Goals: Financial Access, Entrepreneurship, and Sustainable Development in the BRICS Economies” by Associate Professor Dr Lakshmana Rao Ayyagari and his research scholars investigates this delicate balance between economic ambition and environmental responsibility. By applying robust PLS-SEM analysis over the period 2000-2023, the study conducted by the team at SRM AP uncovers the paradox of finance: it fuels entrepreneurship and development, while simultaneously straining sustainability goals.

Financial access acts as both a catalyst and a challenge in today’s rapidly evolving economies. The research article “Balancing Growth and Green Goals: Financial Access, Entrepreneurship, and Sustainable Development in the BRICS Economies” by Associate Professor Dr Lakshmana Rao Ayyagari and his research scholars investigates this delicate balance between economic ambition and environmental responsibility. By applying robust PLS-SEM analysis over the period 2000-2023, the study conducted by the team at SRM AP uncovers the paradox of finance: it fuels entrepreneurship and development, while simultaneously straining sustainability goals.

The findings present a timely call for reimagining financial frameworks that not only strengthen economic systems but also safeguard ecological balance. The research offers actionable insights for policymakers, financial institutions, and communities- pointing towards a future where financial access empowers entrepreneurs without compromising green development.

Abstract

Financial access is a cornerstone of entrepreneurship and a key enabler of economic development. This study examines the dual role of financial systems in promoting entrepreneurial growth and sustainable development across BRICS nations (2000–2023). Using robust PLS-SEM analysis, the research reveals that while financial access drives business formation and economic resilience, it also poses ecological challenges through resource overuse and pollution. The findings highlight a paradox: the same financial mechanisms that foster progress can strain environmental sustainability. The study proposes actionable strategies to align finance with green development goals.

Explanation in Layperson’s Terms

Imagine giving people better access to banks and loans- it helps them start businesses and grow the economy. But, if those businesses use too many natural resources or pollute the environment, growth becomes harmful. This research looks at how countries like Brazil, Russia, India, China, and South Africa (BRICS) can support entrepreneurs without hurting the planet. The goal is to help governments, banks, and businesses grow responsibly by making sure financial tools support both money-making and environmental care.

Practical Implementation of the Research

- Policy Impact: Informs BRICS governments to introduce green credit quotas, eco-tax incentives, and sustainability assessments in funding policies.

- Financial Sector Reform: Encourages banks to incorporate environmental risks into lending practices.

- Community Empowerment: Highlights the importance of inclusive entrepreneurship programs, especially for rural and marginalized communities.

- Sustainability Education: Provides a foundation for integrating sustainability into entrepreneurship curricula and public discourse.

Future Research Plans

- Explore the role of blockchain and AI in promoting transparent, sustainable financial systems.

- Investigate gender and social equity in sustainable entrepreneurship ecosystems.

- Conduct comparative studies on green finance policy innovations beyond BRICS (e.g., ASEAN or African Union).

- Develop longitudinal, mixed-methods frameworks to assess cultural, institutional, and digital factors in sustainability transitions.